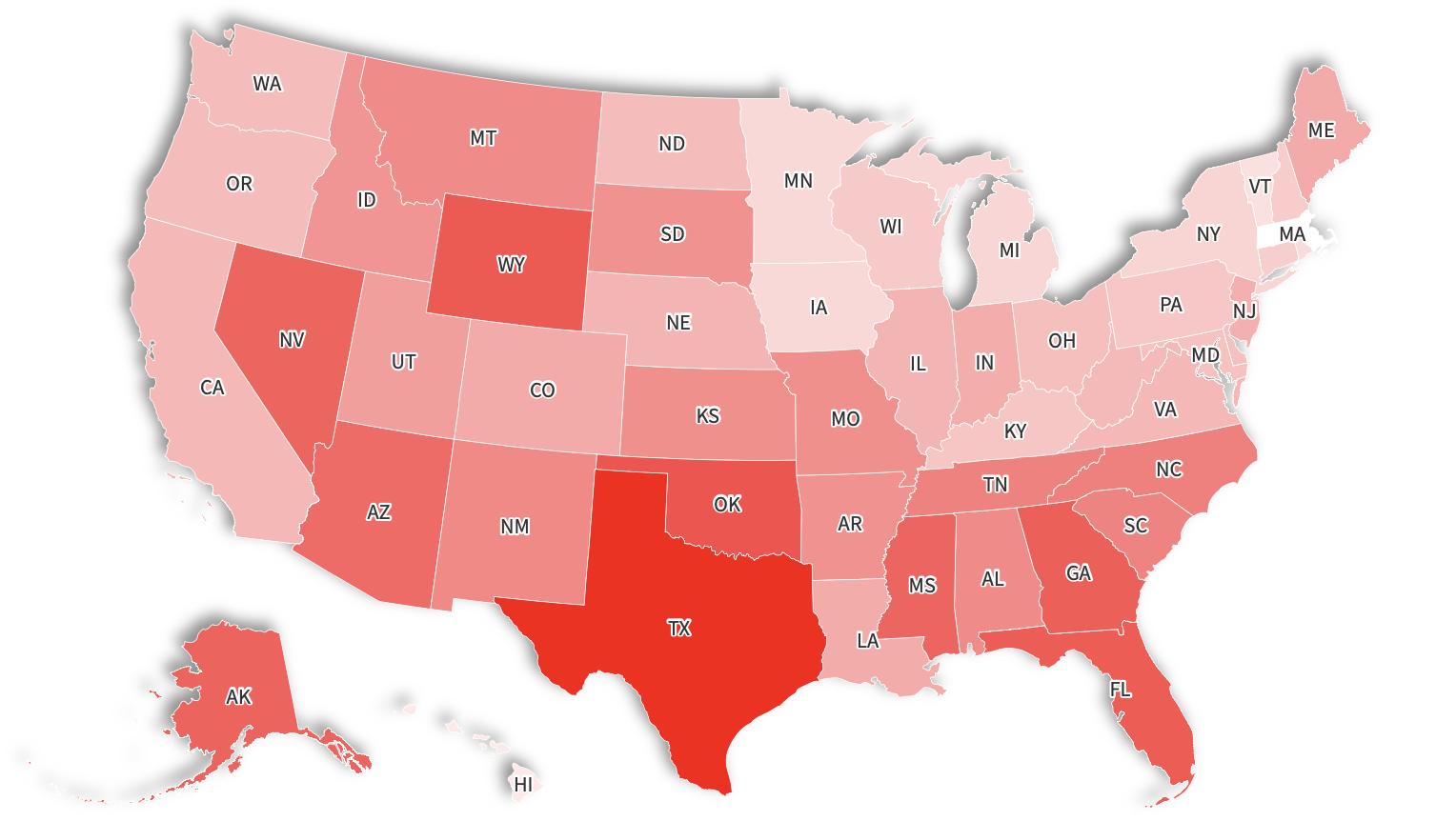

MAP REVEALS STATES WITH LOWEST HEALTH INSURANCE RATES

Health insurance is one of the most important costs associated with living in America, but almost 10 percent of all Americans under 65 years old are not insured.

According to the U.S. Census Bureau, a majority of Americans (92.1 percent) have private health insurance, which typically necessitates paying a deductible, co-insurance and co-pays for medical services and prescriptions. In 2022, 25.6 million working-age and under people were uninsured, according to KFF Health.

The state with the lowest rate of uninsured residents under 65 is Massachusetts, where only 2.9 percent do not have coverage, totaling just over 159,000 people, according to 2022 data. Vermont also has low rates of non-coverage (4.9 percent), as well as Minnesota and Iowa (both 5.4 percent), Michigan (5.5 percent) and New York (5.7 percent).

More From Newsweek Vault: What Is a Checking Account and How Do They Work?

On the other end of the spectrum, Texas has the highest rate of uninsured residents, at 18.8 percent, which amounts to about 4.7 million people. Nearly 1 million are in Harris County, home to Houston, the state's largest city and one of the most populous in the country.

The Lone Star State is followed by Wyoming, which has an uninsured rate of 14.1 percent, and Florida, where 13.9 percent don't have health insurance coverage.

More From Newsweek Vault: Rates Are Still High for These High-Yield Savings Accounts

Men have a slightly higher rate of non-insurance than women, at 10.6 percent, compared to 8.6 percent for women. Among ethnic groups, Native Americans are most likely to be without health coverage, with 18.9 percent uninsured as of 2022. They are closely followed by Hispanic people at 18 percent and Black people at 9.8 percent.

White people are the most likely to have insurance, with 6.7 percent of the population uninsured, according to Census Bureau data.

The risks of not having health insurance are great, making it much more likely that you could end up with a bill you're unable to pay.

The Commonwealth Fund's 2023 Health Care Affordability Survey revealed that 38 percent of those surveyed had delayed or skipped necessary health care or prescriptions because of affordability, with medical debt being the primary reason, cited by 34 percent of those who said they had avoided care.

For those who are covered, medical debt was still prevalent. Roughly one-third of those who said they had employer-sponsored health plans or Affordable Care Act marketplace plans reported having medical or dental debt.

According to analysis by KFF Health, Americans owe about $220 billion in medical debt. Roughly 14 million people (6 percent of adults) owe more than $1,000, with about 3 million people (1 percent of adults) owing medical debt of more than $10,000.

2024-07-26T16:35:19Z dg43tfdfdgfd